does food have tax in pa

Restaurant meals and general purchases are subject to an 8 percent sales tax whereas liquor is subject to a 10 percent sales. Are meals taxable in Pennsylvania.

/cloudfront-us-east-1.images.arcpublishing.com/gray/AUU4WKVNHRIORAI46KVTDIHJH4.jpg)

What S That Vt Use Tax Letter And Do You Have To Pay

Notify your distributors that.

. Generally tax is imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the purchaser or consumer when. This includes food sold by an establishment selling ready-to-eat food. What taxes do you pay in Pennsylvania.

Assuming its a 1100cc it will be about 120. The sale of food and nonalcoholic beverages - by a caterer or eating establishment in Pennsylvania is subject to tax regardless of. Pennsylvania does have an inheritance tax that can be as high as 15 percent but it depends entirely on who is receiving the funds in question.

Statutory or regulatory changes. Sales Use Tax Taxability Lists. Get a Food Establishment Retail Non-Permanent Location License.

Transfers to a spouse or child. While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Exact tax amount may vary for different items.

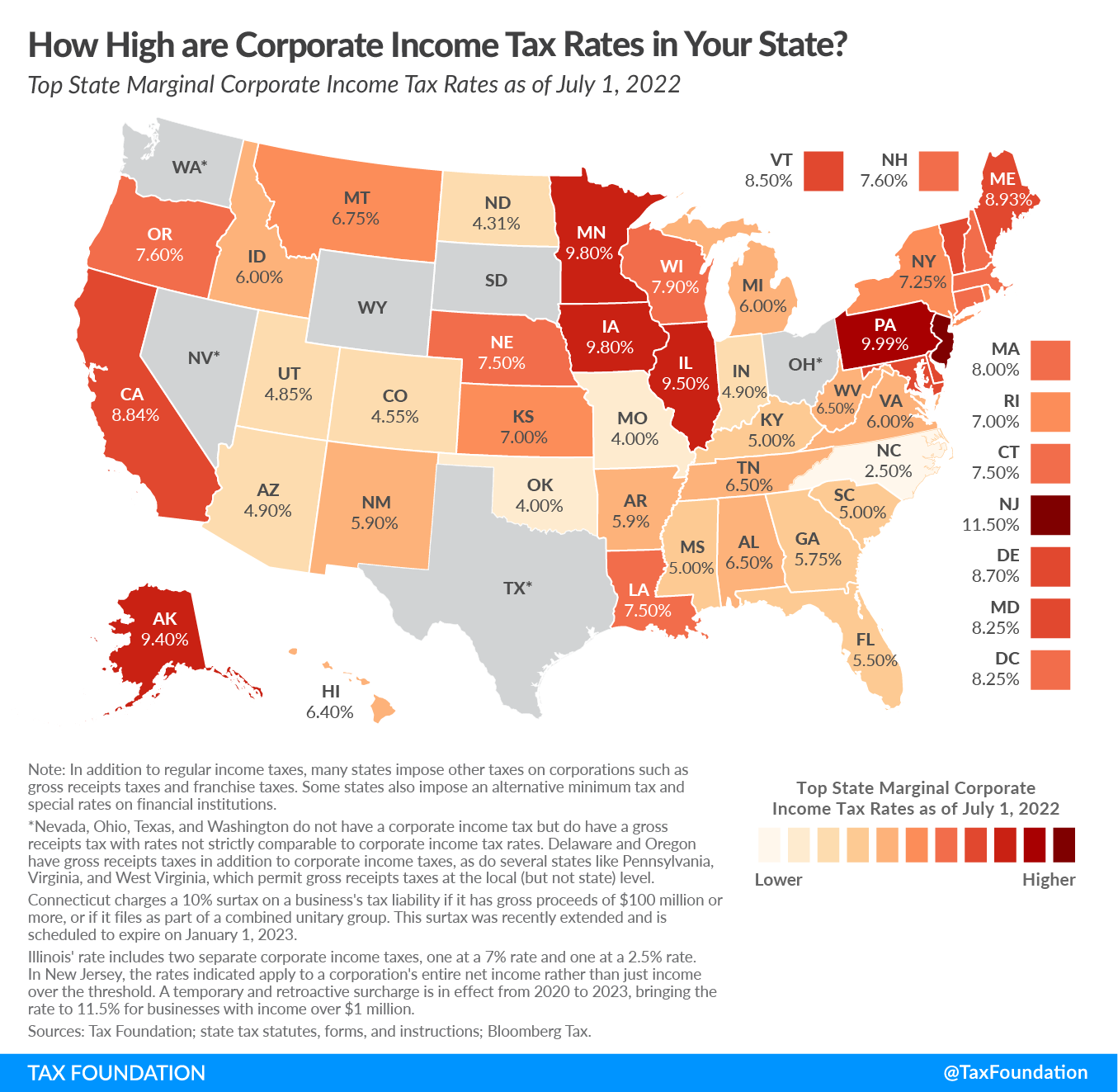

2022 Pennsylvania state sales tax. The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is. Pennsylvania has a 600 percent state sales tax rate a max local sales tax rate of 200.

Meals and prepared foods are generally taxable in Pennsylvania. Pennsylvania does not have a sales tax holiday as of the end of the third quarter of 2022 though a Pennsylvania senator is pushing for a sales tax holiday. The information provided on this page is for informational purposes only and does not bind the department to any entity.

Tea is NOT considered a food - therefore it IS taxedyea tea is a food it is taxed How much is it to get Peugeot 106 taxed. Get a Food Establishment Retail Permanent Location License. In the state of Pennsylvania sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Pennsylvania Tax Rates Collections and Burdens. This page describes the taxability of. The Pennsylvania sales tax rate is 6 percent.

Pennsylvania has a 999 percent corporate income tax rate and permits local gross receipts taxes. Remote and marketplace sellers. Some examples of items that exempt from Pennsylvania.

What is the tax on restaurant food in Philadelphia. Pennsylvania has a 600 percent state sales tax rate a max local sales tax rate of.

Watch Tennessee Sales Tax Holiday On Food Ending Tonight

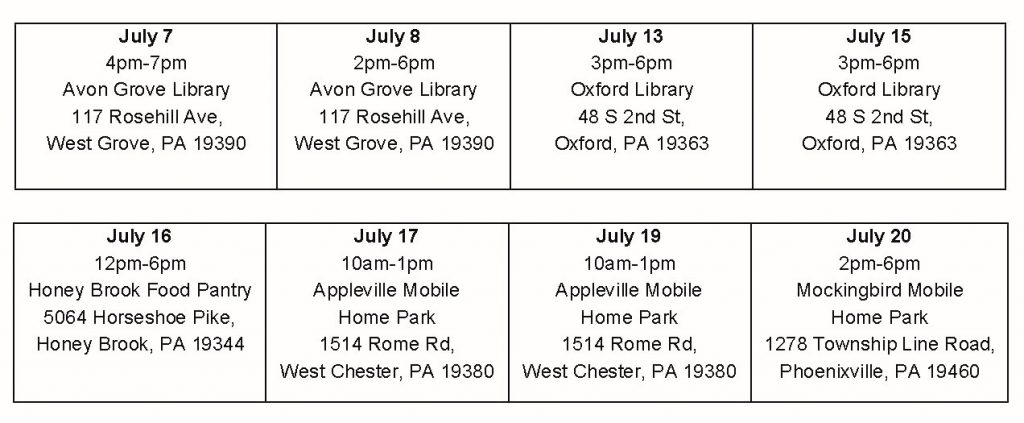

United Way Of Chester County Will Hold Outdoor Outreach Events For Its Mobile Home Tax Reassessment Program United Way Of Chester County

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Food Technologist Salary In Philadelphia Pa Comparably

10 Things You Might Not Know About Pa Taxes Pennlive Com

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

Rizzo S Malabar Inn Crabtree Pa New Item Stuffed Cheese Rigatoni Soon To Be Available In Your Local Grocery Store Facebook

/cloudfront-us-east-1.images.arcpublishing.com/gray/RKBPVIQJ75GPBLEWXC47P55OSU.jpg)

Grand Island Collecting More Revenue From Food Beverage Tax This Year

Everything You Don T Pay Sales Tax On In Pennsylvania From Books To Utilities On Top Of Philly News

States With The Highest Lowest Tax Rates

2017 Cpfb Federal 990 Public Disclosure Tax Return Signed Central Pennsylvania Food Bank

Exemptions From The Pennsylvania Sales Tax

Pennsylvania Tax Rates Rankings Pa State Taxes Tax Foundation

Will A Wealth Tax Affect Singapore S Rivalry With Hong Kong The Japan Times

Pennsylvania Sales Tax Which Items Are Taxable And What S Exempt

Pennsylvania S Quirky Sales Tax System Soft Drinks Are Taxed Candy Gets A Pass Pittsburgh Post Gazette